Most of us talk to our business banker to set up our first account and maybe when we need a loan. The rest of the time, we’re chatting with the tellers or our bank’s digital assistant.

Fostering a better relationship with your banker has serious upside, though. As a self-funded small business owner, your banker is your first call when you need financial backup.

In this Q&A, Lisa Long Jackson, CCIM, a business banking relationship manager with Fifth Third Bank, explains why.

Jill: What are some services business bankers offer their clients that we might not know about?

Lisa: Your business banker can help you with how you make and receive payments. Are you using the free online banking solutions? Are there other ways to incorporate invoicing your clients and collecting funds? They can help you become more efficient and allow your clients to pay you faster.

They also help you prepare to seek funding. They can help you gather the information you need to provide and explain how the bank will analyze your cash flow. It’s also a good idea to check in ahead of your major purchases, too. There may be financing options you hadn’t considered.

What should we talk to our banker about before the end of the year?

I want to help my clients with four things before the year is out:

- A 12-month forecast that captures projections for 2021. Do you expect a cash flow issue? How will you plan for that?

- A year-over-year trend analysis, which shows how you did and helps you understand the reasons for changes in expenses, cost of goods sold, etc.

- Potential capital expenditure (CapEx) purchases or capital improvement plans for next year. Will you need to hire new people or expand your space to hit the targets in your 12-month forecast?

- PPP forgiveness — though hopefully your banker has been in touch about that. If not, definitely make an appointment to discuss this. Get Jill’s take on PPP forgiveness.

What else should we know about working with a business banker?

Your business banker should be on speed dial and in your email contact list so you feel free to contact them with any question or financial need. And as your business grows, be sure you have the right banking partner. At some point, you may need more services than a business banker can offer, like wealth management or mortgage lending. Now’s a good time to find out if your banker has a partner who can help you with your personal banking needs.

This is great advice. Thank you, Lisa!

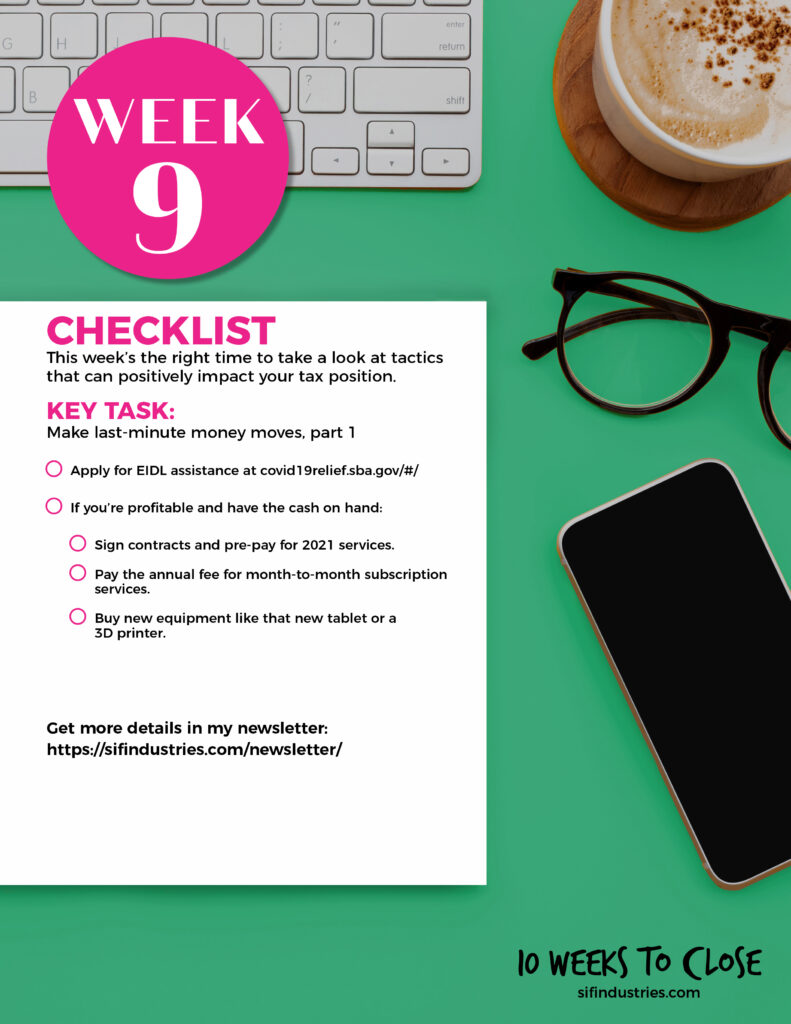

A pro tip: most banks have online appointment-making capabilities so you can identify and schedule a call or virtual introduction with a business banker near you. I’ve included this easy-to-do on this week’s checklist.